Last year, I wrote about how convenient your service was when it came to renewing my motorcycle insurance.

NOW LOOK AT THE MONSTER YOU HAVE BECOME:

AND ON YOUR WEBSITE:

What is – I don’t even – which hamster told you that customers are desirous of this heinous pigletry???

I don’t want to “call [my] agent or [your] 24-hour hotline” because I don’t need to talk to a human being to do this.

I just want to click a button and give you my money so that you can insure Le Poots and I – that is all.

Like what you see in this picture here, just in case you’ve forgotten what convenience and customer service is all about:

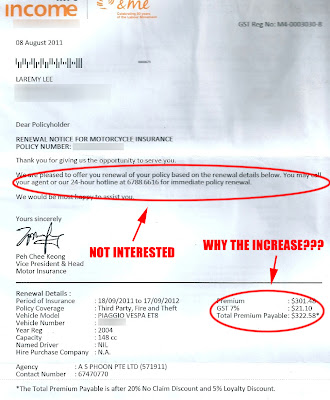

At the same time, it seems my premium has increased to $322.58. Why?

If you think this is an uneducated grouse, don’t worry – I know what the basic principles of insurance entail.

Nevertheless, my question centres on a logical Key Performance Indicator that all efficient insurers should adopt (or should have at least adopted), and that is: insurers must aim to maintain or reduce the year-on-year premiums that a customer has to pay.

But why can’t insurers meet that aim in Singapore?

Is it because of:

- Bad practices and policies with regard to letting drivers and motor workshops inflate claim amounts?

- No one wanting to take the lead by doing the morally correct thing and streamlining/shaking-up the claims process so that us consumers can benefit from ethical decisions?

I have no ready answers.

But if anything, ladies and gentlemen, this is yet another reason why we need honest and customer-oriented people in charge of the organisations and institutions in our country.